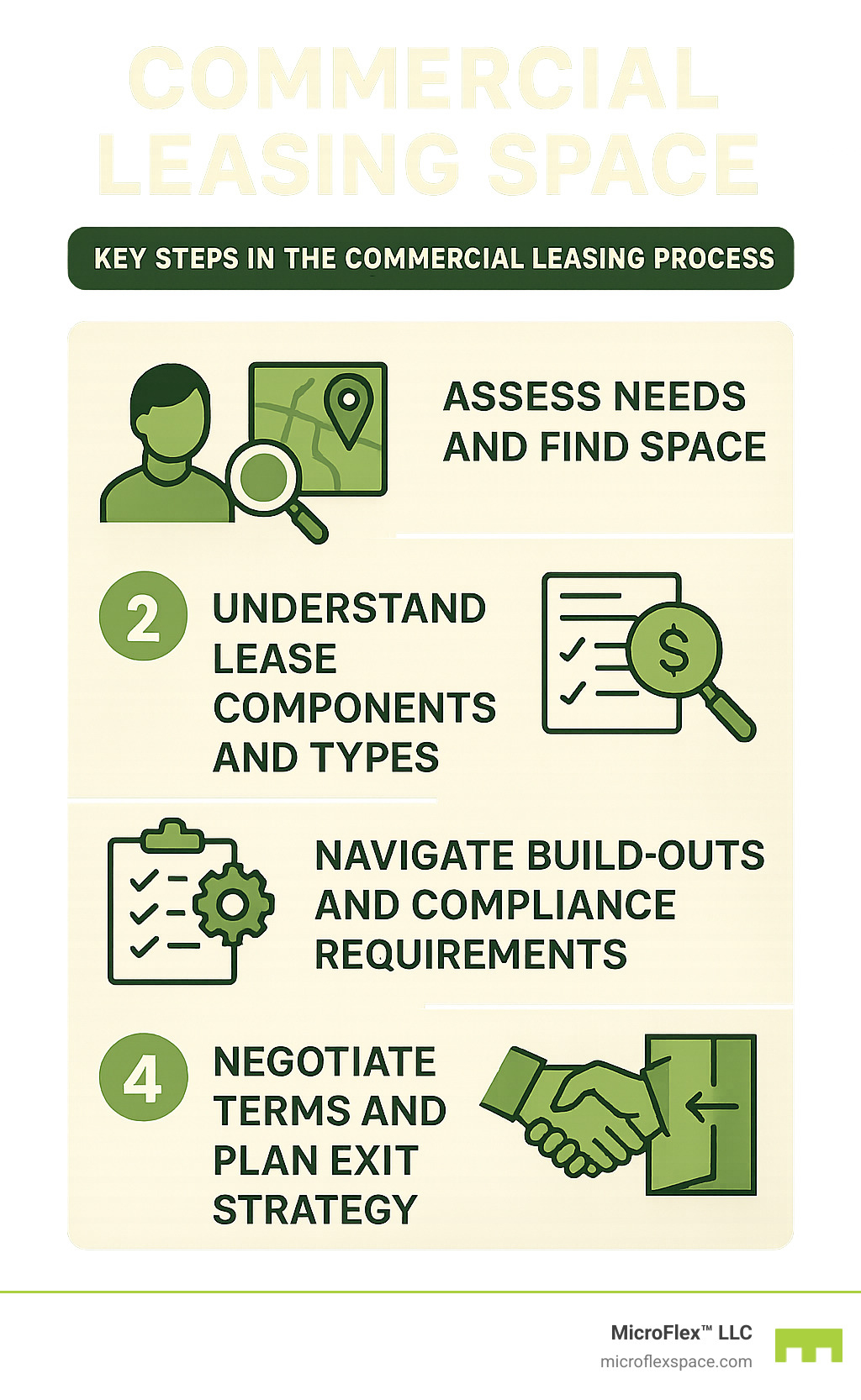

Why Commercial Leasing Space is Your Gateway to Business Success

Commercial leasing space is the process of renting property for business operations, involving a contractual agreement between a landlord and tenant that defines rent, lease terms, responsibilities, and usage rights. Understanding this process is crucial for making strategic decisions that can significantly impact your business’s productivity, growth potential, and bottom line.

Key Elements of Commercial Leasing Space:

- Lease Types: Full-service (gross), net (NNN), and modified gross leases with varying tenant expense responsibilities

- Essential Terms: Lease duration (typically 5-10 years), renewal options, permitted use, and rent escalation clauses

- Hidden Costs: Property taxes, insurance, utilities, maintenance, and common area charges beyond base rent

- Critical Clauses: Assignment rights, subletting permissions, improvement ownership, and break penalties

- Compliance Requirements: ADA accessibility standards, zoning regulations, and insurance obligations

The stakes are high – as research shows, hold-over rates can charge 125%-150% of regular rent, or even double it if lease terms aren’t properly negotiated. From assessing your space needs and budget to understanding complex lease structures, navigating build-out requirements, and planning your exit strategy, each decision affects your business’s future flexibility and financial health. This guide will walk you through the essential steps to ensure you make the right choices.

Simple guide to commercial leasing space terms:

Step 1: Assessing Your Business Needs and Finding the Right Space

Finding the right commercial leasing space starts with looking inward, not outward. Before you fall in love with that gorgeous storefront or spacious warehouse, you need to understand exactly what your business needs to thrive. Think of this as creating a blueprint for your success – because the wrong space can drain your resources faster than you’d imagine.

The truth is, most business owners rush into viewing properties without doing their homework first. They get excited about a great location or a beautiful space, only to realize later that it doesn’t actually serve their business needs. Don’t let that be you.

Assessing Your Needs and Budget

Let’s start with the basics. What type of business are you running? A retail shop needs completely different features than a tech startup or a manufacturing company. If you’re running a restaurant, you need proper ventilation and grease traps. If you’re storing inventory, you need loading docks and security systems. If you’re meeting with clients, you need professional-looking spaces with good parking.

Square footage calculation isn’t just about counting desks and equipment. You need to think about your employee count – both current and projected. Will you be hiring more people in the next few years? What about customer traffic patterns? Some businesses need wide aisles and open spaces, while others can work with more compact layouts.

Location matters more than you might think. Proximity to suppliers can save you thousands in shipping costs over the life of your lease. Parking availability affects both your employees and customers. These details might seem small now, but they add up quickly.

Now comes the reality check – budgeting for your commercial leasing space. The base rent is just the beginning. Hidden costs like utilities, maintenance fees, and property taxes can easily add 20-30% to your monthly expenses. Many first-time lessees get sticker shock when they see their first full bill.

Here’s what catches most people off guard: very few spaces are move-in ready. You’ll likely need to invest in renovations, IT setup, and basic improvements to make the space work for your business. Factor these costs into your budget from day one.

Finding the Right Property

Once you know what you need, it’s time to find it. Online listings are a great starting point, but they don’t tell the whole story. You’ll find plenty of options on various commercial real estate platforms, though some of the best properties might not be publicly advertised.

This is where commercial real estate agents can be worth their weight in gold. A good tenant representation specialist knows the local market inside and out. They can show you properties before they hit the market, help you understand fair market rates, and spot potential problems you might miss. Think of them as your guide through unfamiliar territory.

When you’re ready to tour properties, don’t just look at the space itself. Pay attention to the landlord reputation – are they responsive and professional? Do current tenants seem happy? A difficult landlord can turn your dream space into a nightmare.

Zoning laws and local regulations aren’t the most exciting topics, but they’re crucial. You absolutely must verify that your intended business use is permitted in that location. Operating in the wrong zone can lead to fines, forced closure, or expensive relocations. When in doubt, check with local authorities or consult with a professional.

Consider whether traditional office space is your only option. Coworking arrangements offer flexibility and shared amenities without long-term commitments. They’re perfect for startups or businesses with changing needs. On the other hand, if you need dedicated space with specific configurations, a traditional lease might serve you better.

At MicroFlex™ LLC, we’ve designed our spaces to bridge that gap. Our Multi-Use Commercial Property options combine warehouse, office, storage, and showroom features in one flexible package. Whether you need Warehouse Office Space for Rent or something more specialized, we can adapt to your changing needs without forcing you into a rigid lease structure.

The key is finding a space that grows with you. Your business won’t stay the same size forever, and your commercial leasing space shouldn’t lock you into yesterday’s requirements. Look for landlords and properties that understand this reality and can work with you as your needs evolve.

If you’re searching for Commercial Leasing Near Me, the “right” location balances your operational needs, budget constraints, and growth plans. Take your time with this step – it’s the foundation everything else builds on.

Step 2: Understanding the Core Components of a Commercial Lease

Once you’ve found a promising space, it’s time to dive into the heart of commercial leasing space – the lease agreement itself. Think of this document as the DNA of your business relationship with your landlord. It’s not just paperwork; it’s a legally binding contract that will shape your daily operations and financial obligations for years to come.

Too many business owners get caught off guard by clauses they didn’t fully understand. A magnifying glass approach to reading every detail is absolutely essential. The difference between a well-negotiated lease and a problematic one can literally make or break your business.

Types of Commercial Leases

The structure of your lease determines who pays for what – and this can dramatically impact your monthly expenses. There are three main types of commercial leasing space agreements, each with different cost responsibilities.

Full-Service (Gross) Lease offers the most predictable monthly expenses. You pay one fixed rent amount, and your landlord handles property taxes, insurance, utilities, and common area maintenance (CAM). It’s like an all-inclusive resort for your business – you know exactly what you’ll pay each month, making budgeting much simpler.

Net Lease (NNN) works differently. You’ll pay a lower base rent, but then add your share of operating expenses on top. These typically include property taxes, building insurance, and common area maintenance. The “triple net” name comes from these three main expense categories that pass through to tenants.

Modified Gross Lease splits the difference. Some operating expenses are included in your base rent, while others become your responsibility. This hybrid approach requires careful reading to understand exactly which costs you’ll handle versus what the landlord covers.

At MicroFlex™ LLC, we work with our tenants to structure lease terms that make sense for their specific business needs. Our Business Real Estate Lease options are designed to provide clarity and flexibility, whether you need predictable monthly costs or prefer the potentially lower base rent of a net lease structure.

Key Clauses in a commercial leasing space Agreement

Beyond the rent structure, several critical clauses deserve your close attention. Lease term length sets the foundation – most commercial leases run 3-10 years, much longer than residential rentals. This long commitment protects landlords but can feel daunting for growing businesses.

Renewal options give you the right to extend your lease under predetermined terms. Without this clause, you might face uncertainty about staying in your space or potentially steep rent increases. Always negotiate for at least one renewal period if your business might need more time to establish itself.

Permitted use clauses define exactly what business activities you can conduct in the space. A restrictive clause might prevent you from expanding your services or pivoting your business model. Make sure the language covers not just your current operations but reasonable future growth.

Rent escalation clauses outline how your rent will increase over time. Some leases include automatic annual increases based on a fixed percentage or tied to inflation. Others might have stepped increases at specific intervals. Understanding these escalations helps you project long-term costs accurately.

Assignment and subletting rights become crucial if your business needs change. Can you transfer your lease to a buyer if you sell your business? Can you sublet part of your space if you downsize? These clauses provide valuable flexibility – or dangerous restrictions if not properly negotiated.

Default and holdover clauses spell out what happens if things go wrong. Default clauses outline the consequences of late rent or lease violations. Holdover clauses can be particularly expensive – staying beyond your lease term might cost 125-200% of your regular rent.

The complexity of these agreements is exactly why many businesses work with experienced commercial real estate professionals. At MicroFlex™ LLC, we believe in transparent, straightforward lease terms that support your business success rather than create obstacles. Our flexible approach to commercial leasing space means we can often accommodate special requirements that larger commercial landlords might reject outright.