The Rise of Multi-Use Commercial Properties: Flexible Spaces for Modern Needs

When you think about the future of commercial real estate, multi use commercial property is leading the charge. These versatile spaces blend multiple functions—retail storefronts, professional offices, residential units, and sometimes even light industrial—all under one roof or within a single development. And let me tell you, they’re becoming the darling of both investors and tenants alike.

Why are these properties gaining so much traction? Simple: they offer something traditional single-use properties can’t—flexibility and diversification. As someone who’s watched the Alabama commercial market evolve, I’ve seen how these properties weather economic storms better than their single-purpose counterparts.

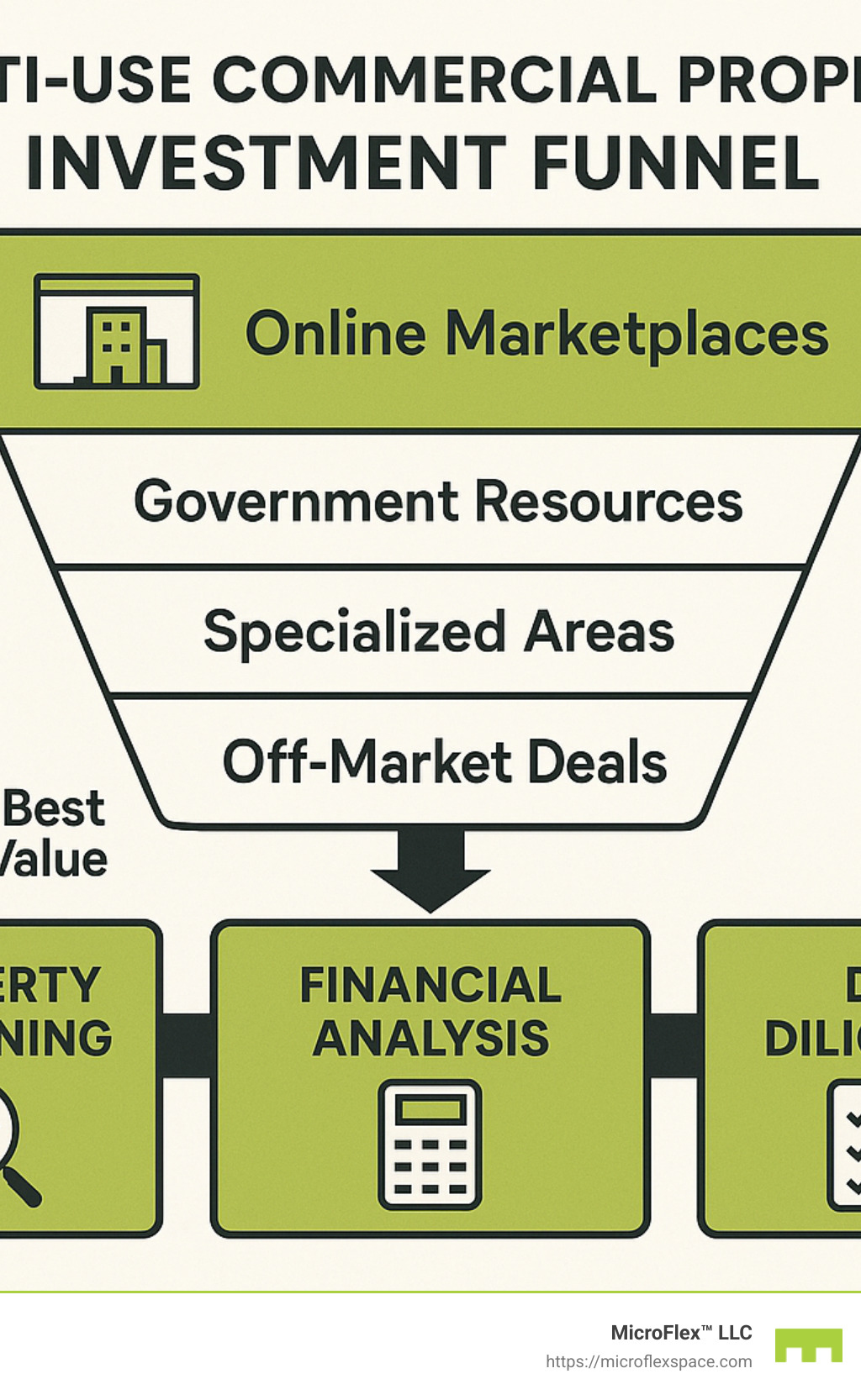

Finding these gems requires knowing where to look. The most successful investors tap into several key sources. Online marketplaces like LoopNet showcase over 100,000 commercial listings, while CommercialEdge maintains an impressive database of more than 13 million property records. But the real deals? Those often come through relationships—broker networks, neighborhood scouting, and carefully cultivated industry connections.

Don’t overlook government resources either. County planning portals, zoning notices, and tax records often reveal opportunities before they hit the mainstream market. And for those willing to do a bit more homework, transit-oriented developments and designated redevelopment districts frequently offer incentives that boost your bottom line.

For the bargain hunters among us, distressed opportunities through auctions, bank-owned properties, and receiverships can sometimes yield exceptional value—though they require quick action and thorough due diligence.

What makes multi use commercial property truly special is its built-in safety net. When one sector faces challenges, the others can help carry the load. Retail slowdown? Your office tenants keep the rent flowing. This income diversification is like having multiple investments in one property.

Today’s tenants and consumers crave convenience—walkable communities where they can live, work, shop, and play without lengthy commutes. As Judy Guarino of JPMorgan Chase so aptly puts it, “It’s about having easy access to the things that you need in your everyday life.” This fundamental shift in preference is driving sustained demand that shows no signs of slowing.

I’m Sam Zoldock, and I’ve made it my business to understand the nuances of multi use commercial property throughout Alabama. Whether you’re looking for value-add opportunities or stabilized assets with reliable returns, the mixed-use sector offers compelling options for strategic investors who recognize its long-term potential.

1. County & City Planning Portals: The Earliest Source of Listings

Want to know the secret to finding amazing multi use commercial property deals before anyone else? Look no further than your local government websites. These often-overlooked digital filing cabinets are treasure troves of opportunity for savvy investors.

County and city planning portals aren’t exactly winning design awards, but behind those clunky interfaces lies valuable information about properties that haven’t hit the mainstream market yet. Think of it as getting tomorrow’s property listings today!

When you dig through these public records, you’ll find properties going through rezoning from single-use to mixed-use, tax-delinquent properties that might soon be available, and building permit applications hinting at upcoming redevelopments. You’ll also find notices about zoning changes that could dramatically increase property values in certain areas.

Research from sustainable city planning organizations shows that mixed-use zoning is becoming increasingly popular as municipalities work to create more vibrant, walkable communities. This shift creates perfect opportunities for investors who keep their eyes on these portals.

As Judy Guarino of JPMorgan Chase puts it: “In major cities you can’t expand out—you can only expand up.” This reality explains why so many urban areas are embracing the multi-use development model.

How to Mine Data Before Anyone Else

Getting ahead of other investors isn’t about luck—it’s about developing a systematic approach to monitoring these resources. Here’s how to become a data mining pro:

Start by setting up regular parcel lookups in your target neighborhoods. County assessor websites typically let you search by address, owner name, or parcel number. Make this a weekly habit, and you’ll start noticing patterns and opportunities others miss.

Learning to steer GIS maps is another valuable skill. These interactive maps often display zoning boundaries, planned developments, and property details all in one place. They might seem complicated at first, but spending an hour learning the interface can pay huge dividends.

Don’t underestimate the value of attending pre-application meetings at local planning departments. These meetings are where developers discuss upcoming projects, often months before construction begins. You might be the only investor in the room!

One Birmingham investor told me: “I found my mixed-use building by noticing a rezoning application in an up-and-coming neighborhood. I contacted the owner directly before they even listed it and secured a deal $50,000 below what it would have commanded on the open market.”

At MicroFlex™, we’ve seen clients use these exact strategies to identify promising areas before establishing their businesses in our flexible spaces across Alabama. They’re often amazed at how much information is publicly available—if you just know where to look.

In multi use commercial property investing, information is everything. And sometimes, the best information comes from the most mundane sources—like that planning department website you’ve been ignoring.

2. Dedicated CRE Marketplaces & Databases You Can’t Ignore

Looking for multi use commercial property deals? The digital marketplace revolution has transformed how we find commercial real estate opportunities. While government resources give you early leads, these specialized platforms deliver the motherlode of listings in one convenient place.

The sheer volume is impressive – LoopNet alone showcases around 100,000 mixed-use property listings at any given time. Meanwhile, CommercialEdge Research maintains a treasure trove exceeding 13 million property records. With approximately 270,000 active listings across specialized CRE platforms and about 1,000 fresh properties added daily, these resources are simply too valuable to ignore.

I remember when finding commercial properties meant endless phone calls and driving around with brokers. Today, these platforms put comprehensive property data at your fingertips with search capabilities that would make old-school investors green with envy.

Setting Smart Filters for multi use commercial property Leads

The secret to not drowning in this ocean of listings? Smart filters that zero in on exactly what you’re looking for.

Start with asset class tags by selecting specifically for “mixed-use” or combinations like “retail/residential” to narrow your focus. Then set your cap rate range to align with your investment goals – are you hunting for cash flow or appreciation potential?

Price per square foot comparisons can reveal hidden gems trading below market averages. And don’t forget to consider vertical versus horizontal configuration options based on your management style and target tenant mix. A vertical mixed-use building (retail on ground floor, apartments above) requires different management skills than a horizontal strip with various businesses side-by-side.

“Using a dedicated CRE research platform with specific search filters for property size, sale history and zoning can save hundreds of hours in your property search,” notes a CommercialEdge researcher. I couldn’t agree more – these tools compress weeks of legwork into minutes of clicking.

Here’s a pro tip we’ve observed at MicroFlex™ LLC: Set up saved searches with email alerts to get instant notifications when new properties matching your criteria hit the market. Our clients who use automated alerts typically pounce on new listings 48 hours faster than those who don’t – often the difference between snagging a deal and missing out.

These platforms aren’t just about quantity – they’re about quality information that helps you make smarter decisions faster. Connect with LoopNet to stay updated on the latest features and opportunities in the mixed-use commercial space.

3. Off-Market Networking & Brokers: Your Shortcut to Multi Use Commercial Property Steals

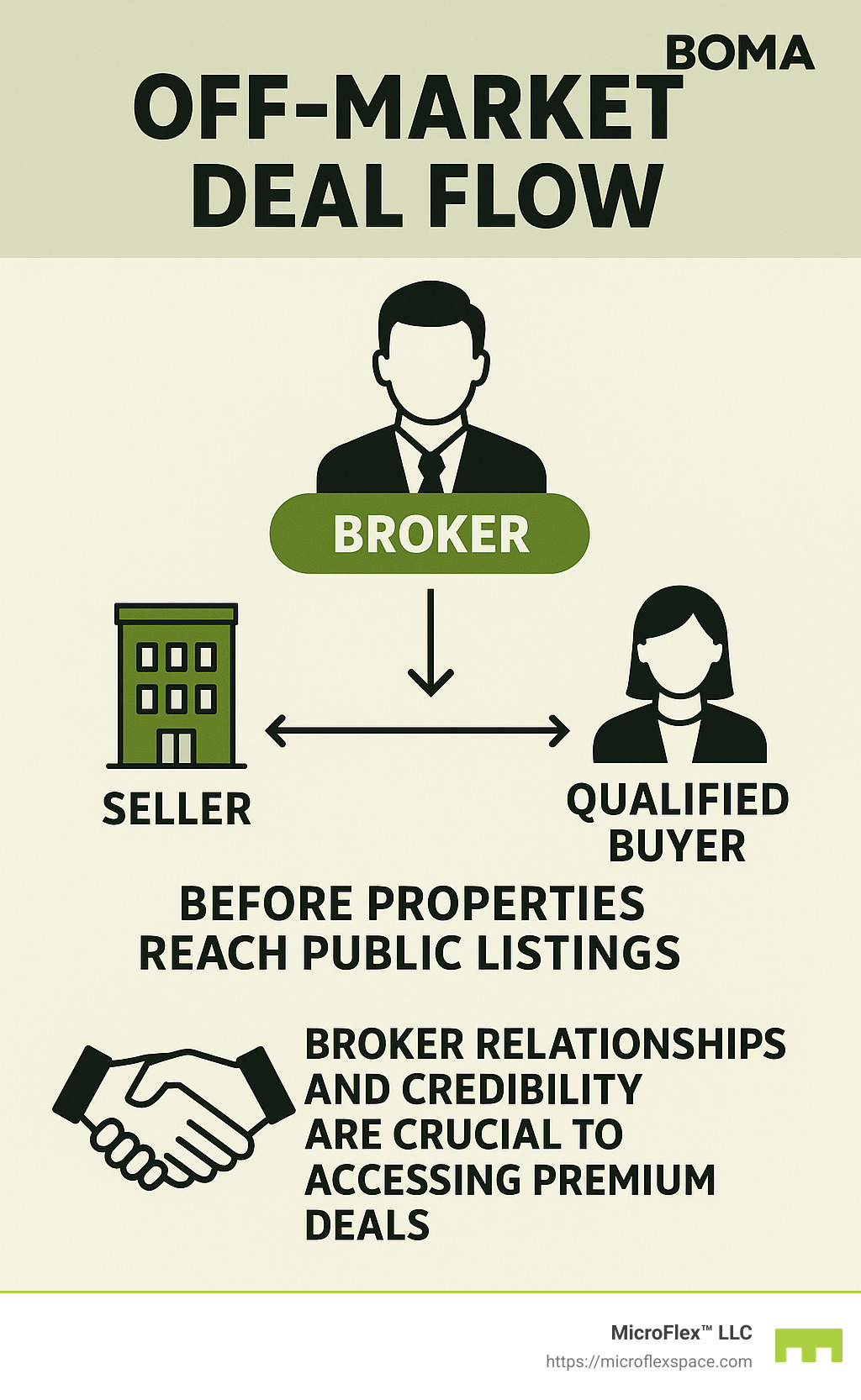

The most savvy investors know a secret about multi use commercial property deals: some of the best opportunities never see the light of public listings. These hidden gems often change hands through quiet conversations and established relationships.

I’ve seen countless investors miss amazing opportunities simply because they weren’t plugged into the right networks. Getting yourself on broker mailing lists can be your first step toward hearing about properties before they hit the market. Many brokers send “coming soon” alerts to their trusted contacts days or even weeks before public listings appear.

Don’t underestimate the power of old-fashioned neighborhood drive-bys either. One investor I know regularly drives through developing areas with a notepad, jotting down properties that show potential. When she spots something interesting, she’ll often approach the owner directly with a letter or phone call. This proactive approach landed her a mixed-use building in Birmingham at 15% below market value.

As one Reddit user shared: “I recently bought a mixed-use building in Englewood. I knew the building and saw the owner wanted to sell and reached out to the broker.” This kind of initiative often separates successful investors from the pack.

Building Relationships That Surface the Best Multi Use Commercial Property First

Let me be frank: brokers are busy people who prioritize clients they know can close deals. If you want to be first on their call list when that perfect multi use commercial property comes along, you need to position yourself as a serious player.

Creating a simple credibility package can work wonders. This doesn’t need to be fancy—just a one-pager outlining your investment experience, criteria, and financial capacity. I’ve seen brokers completely change their tone when presented with a professional summary of an investor’s capabilities.

Having proof of funds ready shows you’re not just window shopping. As one blunt forum contributor put it, “No money, no honey”—meaning brokers quickly determine who’s serious about closing deals.

The power of lunch meetings shouldn’t be underestimated either. Breaking bread with key brokers in your target markets builds the personal connection that can put you at the top of their minds when opportunities arise. One investor I know sets a calendar reminder to check in with his top five broker contacts every six weeks, either in person or with a quick phone call.

Perhaps most importantly, always follow through on commitments. The commercial real estate community is smaller than you might think, and your reputation will precede you. If you say you’ll submit an offer by Thursday, make sure it happens. This reliability builds the trust that open ups doors to exclusive deals.

At MicroFlex™ LLC, we’ve built strong relationships with brokers across Alabama over the years. These connections have been instrumental in helping us identify prime locations for our flexible space developments in Birmingham-Irondale, Birmingham-Hoover, Huntsville, and Auburn-Opelika. We’ve found that maintaining honest, dependable relationships with our broker network has given us access to opportunities that would have otherwise gone to competitors.

In commercial real estate, who you know often matters just as much as what you know. Your next great multi use commercial property deal might be just one relationship away.

4. Mixed-Use Redevelopment Districts & Opportunity Zones

Targeted economic development areas represent hidden treasure troves for savvy multi use commercial property investors looking for their next big win.

These special districts aren’t just lines on a map—they’re carefully crafted zones where economic incentives, favorable zoning, and growing demand intersect. Think of them as fertile soil where your investment can truly flourish.

Adaptive reuse zones breathe new life into forgotten industrial buildings. There’s something magical about changing a century-old factory into vibrant spaces where people live, work, and play. These conversions often preserve architectural character while creating thoroughly modern interiors.

The charm of Main Street revival programs can’t be overstated. These initiatives focus on bringing downtowns back from the brink, creating walkable communities where ground-floor retail supports upper-level apartments or offices. The nostalgia factor alone drives significant foot traffic!

History buffs (and tax-savvy investors) love historic districts where preservation tax credits can substantially offset renovation costs. Yes, there are more regulations to steer, but the financial incentives often make the extra paperwork worthwhile.

Opportunity Zones represent perhaps the most significant tax advantage play in commercial real estate today. Created by the 2017 Tax Cuts and Jobs Act, these zones offer remarkable capital gains tax benefits for patient investors willing to improve properties and hold them long-term.

As one developer told me recently, “Brooklyn’s Williamsburg and Queens’ Long Island City transitioned from factories to multifamily and retail,” perfectly illustrating how formerly industrial areas can transform into thriving mixed-use communities when the right incentives align with market demand.

Valuing Redevelopment Sites vs. Stabilized Assets

Let’s be honest—putting a price tag on redevelopment opportunities requires a completely different mindset than valuing stabilized properties. You’re not buying what’s there today; you’re investing in what could be tomorrow.

| Metric | Stabilized Mixed-Use | Redevelopment Opportunity |

|---|---|---|

| Cap Rate | 5-7% typical | Not applicable (no current income) |

| IRR | 8-12% | 15-25% |

| Holding Period | 5-10 years | 2-5 years |

| Risk Level | Moderate | High |

| Financing | Traditional CRE loans | Construction/bridge loans |

When evaluating redevelopment opportunities, focus on the income approach to valuation, but with a twist—you’re projecting future income after improvements, not just analyzing current rent rolls. Factor in realistic construction costs (and always add a contingency buffer—trust me on this one).

A market analyst I regularly consult notes, “Multi use commercial property tends to maintain value well, even in turbulent market conditions, due to their diversified tenant base and continuous demand.” This resilience makes them particularly attractive in redevelopment zones where neighborhood change can significantly boost property values almost overnight.

At MicroFlex™ LLC, we’ve seen this firsthand. Our developments in several redevelopment districts offer short-term warehouse rental options that provide crucial flexibility during transition periods. Our Birmingham-Irondale MicroFlex Location showcases how multi-function spaces can thrive in revitalized industrial areas that once seemed forgotten.

The beauty of these districts is how they combine the old with the new—historic architecture with modern amenities, ground-floor retail with upper-level living, all creating vibrant communities where people genuinely want to be. And as any experienced investor will tell you, finding properties where people want to be is half the battle.

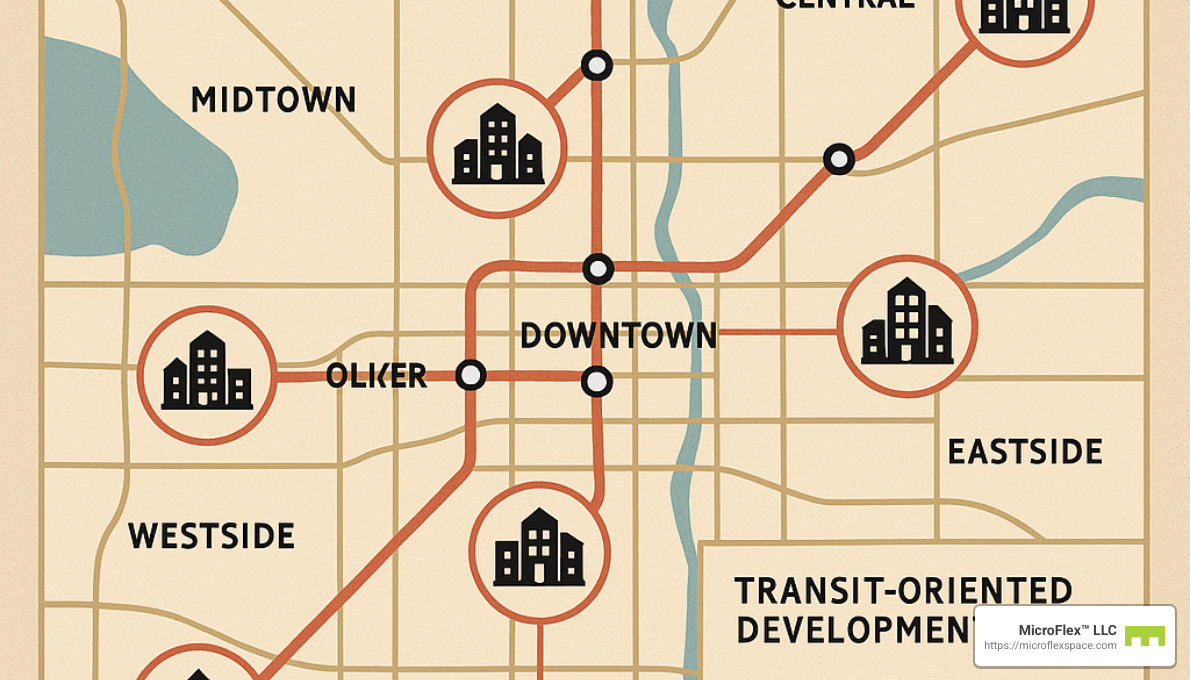

5. Transit-Oriented & Walkable Hotspots for Higher ROI

Looking for multi use commercial property with exceptional returns? Look no further than transit-oriented developments (TODs) – they’re where savvy investors are finding gold mines these days.

I’ve watched these vertical towers near transit hubs transform neighborhoods across Alabama and beyond. What makes them special? For starters, tenants happily pay premium rents for the convenience of stepping outside and having everything they need within walking distance. This translates directly to your bottom line through consistently lower vacancy rates compared to properties stranded in car-dependent areas.

The millennial and Gen Z demographics are driving this trend, with their strong preference for walkable communities where they can live, work, and play without the hassle of constant driving. As one property owner told me, “My mixed-use building near the light rail filled up twice as fast as my suburban property – and at higher rents!”

Sustainability isn’t just a buzzword anymore – it’s becoming a major selling point. “Higher density in mixed-use projects conserves resources and reduces car dependence,” as an industry colleague recently pointed out to me. This eco-friendly aspect appeals to modern tenants who want to reduce their carbon footprint while enjoying a more convenient lifestyle.

The appreciation potential is particularly exciting as transit networks continue to expand in growing metros. Properties that might seem merely “well-located” today could become premium transit hubs tomorrow as cities invest in expanded public transportation infrastructure.

Financing Options Custom to Multi Use Commercial Property Near Transit

When it comes to financing these transit-friendly properties, you’ve got some interesting specialized options in your toolkit.

The SBA 504 loan program is a favorite among my clients who plan to occupy part of their mixed-use building. These loans typically offer lower down payments and longer terms than conventional financing, making them perfect for owner-operators looking to establish their business in a vibrant location.

For properties with substantial residential components, FHA-insured multifamily loans can be an excellent option. These loans are particularly attractive if you’re developing apartments above ground-floor retail or office space – a classic transit-oriented configuration.

If your project incorporates green building features (which many TODs do), you might qualify for sustainability-focused financing with competitive rates. Lenders are increasingly recognizing the lower risk profile of environmentally conscious developments.

Don’t overlook potential transit authority partnerships either. Many cities offer development incentives for projects that increase ridership on their transit systems. These can include tax abatements, density bonuses, or even direct financial participation.

Research from CommercialSearch confirms what we’re seeing on the ground: “The surge in popularity of mixed-use is driven by shifting lifestyle preferences toward walkable communities.” This isn’t just a passing trend – it’s a fundamental shift in how people want to live and work.

At MicroFlex™ LLC, we’ve taken this insight to heart. We strategically locate our flexible spaces near major transportation corridors to give our tenants the convenience they crave while maintaining the adaptability that makes our multi-function spaces so valuable. Whether you need warehouse, office, storage, or showroom features, we believe accessibility shouldn’t be an afterthought – it should be built into the foundation of your business location strategy.

6. Auction & Distressed-Asset Platforms: Hunting for Bargains

For investors with an appetite for a bit more risk and an eye for diamonds in the rough, distressed multi use commercial property can be a treasure trove of opportunity.

Think of distressed property hunting as the commercial real estate equivalent of bargain shopping – with potentially much bigger rewards. These properties typically come from several sources that savvy investors keep on their radar.

Bank-owned properties (also called REO or real estate owned) often represent great value, as financial institutions aren’t in the business of property management and usually want these assets off their books quickly. Online commercial auction platforms have made accessing these opportunities easier than ever, with many allowing you to bid from the comfort of your home office.

Properties in receivership due to bankruptcy or foreclosure can be particularly interesting for mixed-use investors. These buildings frequently come with established tenant mixes but suffer from management issues that a hands-on investor can resolve.

Don’t overlook 1031 exchange listings with motivated sellers facing tight deadlines. These time-pressed owners often prioritize a quick, certain close over maximizing their sale price – sometimes resulting in discounts of 10-30% below market value.

“If you’re looking for a way to maximize your investment and gain the most from your location, consider distressed properties with redevelopment potential,” advises a commercial real estate specialist I recently spoke with at an industry conference.

The catch? You’ll need to act quickly and conduct thorough due diligence, often under tight timelines. Having a comprehensive checklist for property evaluation is essential – covering everything from title issues to building systems to environmental concerns.

Quick-Close Strategies to Capture Underpriced Multi Use Commercial Property

Success in the distressed multi use commercial property market requires preparation and speed. I’ve watched many investors miss great opportunities simply because they couldn’t move fast enough.

The most successful bargain hunters arrange hard money or bridge financing well before they need it. These funding sources might charge higher interest rates, but they can close in days rather than weeks – a crucial advantage when competing for distressed properties.

Building relationships with title companies that can perform expedited reviews is another smart move. The title professional who can clear issues quickly becomes an invaluable ally in distressed property acquisitions.

Having a team of reliable inspectors on speed dial who understand commercial mixed-use properties and can work under pressure is equally important. I know an investor who maintains relationships with three different inspection companies just to ensure someone is always available on short notice.

Perhaps most importantly, be mentally and financially prepared for as-is purchases with appropriate contingency budgets. As one seasoned investor told me, “Maintain 6–12 months of operating capital before opening.” This financial cushion can make the difference between stress and success when inevitable surprises arise.

I recently spoke with an investor who purchased a distressed strip mall and converted it to a mixed-use development with ground-floor retail and upper-floor offices. “I was able to close in 15 days with hard money, then refinance six months later after stabilizing the property, nearly doubling my equity,” she shared with a smile.

Our MicroFlex™ LLC Birmingham-Irondale location actually began as a distressed property opportunity that we recognized had tremendous potential for flexible, multi-use spaces. Today, it’s a thriving hub where businesses customize their space for warehouse, office, storage, or showroom needs – proving that vision and execution can transform distressed properties into valuable community assets.

Want to see what’s possible with the right mixed-use vision? Check out our Birmingham Irondale MicroFlex Location for inspiration.

Frequently Asked Questions about Finding Deals on Multi Use Commercial Property

Investors often ask me the same questions when they’re hunting for that perfect multi use commercial property. Let’s tackle the most common ones I hear during seminars and client meetings.

How do I estimate value on a mixed-use listing I found?

Figuring out what a mixed-use property is actually worth can feel like solving a puzzle with pieces from different boxes. Unlike single-use properties, you’re dealing with multiple income streams and usage types under one roof.

Start with comparable sales in your target area, but remember—no two mixed-use properties are exactly alike. A three-story building with retail on the ground floor and apartments above might look similar to another nearby, but tenant quality and lease terms can drastically change the value.

Always get your hands on the current rent roll. This document is gold—it shows exactly what income the property generates right now. One property manager I know in Birmingham puts it this way: “The rent roll tells the true story that the seller’s optimistic projections might not.”

Don’t forget to apply realistic vacancy assumptions for each section of the property. Retail spaces typically have different vacancy rates than apartments or offices. The retail portion might run at 10% vacancy while the residential units stay at just 5%.

Location value matters tremendously with mixed-use. A property’s walkability score or proximity to transit can add significant premium, especially in urban areas where car-free living is gaining popularity.

What financing programs work best for first-time mixed-use investors?

Financing your first multi use commercial property doesn’t have to be intimidating. Several paths can get you there without requiring a fortune in cash.

Traditional commercial loans remain the most common route, typically requiring 25-30% down payment. Local banks often understand the mixed-use market better than national lenders and might offer more favorable terms if you build a relationship.

For hands-on business owners planning to occupy part of the building, SBA 504 loans are practically a gift. With down payments as low as 10%, they make entry into mixed-use ownership much more accessible. One of our clients in Huntsville used this option to purchase a building where he runs his business on the ground floor while collecting rent from upstairs tenants.

Don’t overlook equity partnerships as a strategy. By teaming up with experienced investors, you can contribute a smaller portion of capital while learning the ropes. I’ve seen successful partnerships start with as little as 10% ownership for the junior partner.

Seller financing sometimes offers the most flexible terms of all. One property owner in Auburn was approaching retirement and offered to finance 50% of the purchase price for five years—giving the buyer time to establish cash flow before refinancing.

Do multi use commercial property investments require special management skills?

Yes—and this is where many first-time investors get surprised. Managing multiple use types under one roof requires a broader skill set than single-use properties.

Tenant mix optimization becomes an art form with mixed-use. The right combination creates synergy; the wrong one creates headaches. Imagine a noisy bar below quiet residential units, or a high-end boutique next to a discount store. These combinations can undermine the value of both spaces.

Understanding CAM (Common Area Maintenance) allocation gets tricky when you have different tenant types sharing common spaces. Should the ground-floor retail tenant who benefits from lobby foot traffic pay more than the third-floor office tenant? These decisions require thoughtful planning.

Hybrid lease structures add another layer of complexity. Retail leases often include percentage rent based on sales, while office leases might have different escalation clauses than residential leases. As one property manager told me, “It’s like speaking three different languages on any given day.”

Different property uses also face different regulatory requirements. Residential units may need to meet housing codes that don’t apply to commercial spaces, while retail areas might have specific health department regulations.

The diversity of tenant types does create more stable cash flow, which is why many investors love mixed-use despite the management challenges. As one Birmingham investor puts it: “When office space demand drops, my residential units keep the bills paid. When housing slows down, my retail tenants keep the income flowing.”

Many new investors wisely choose professional property management companies until they learn the ropes. At MicroFlex™ LLC, we’ve worked hard to simplify these complexities by creating standardized yet flexible spaces across our locations in Birmingham-Irondale, Birmingham-Hoover, Huntsville, and Auburn-Opelika. Our units combine warehouse, office, storage, and showroom features under consistent management practices, making mixed-use ownership much more approachable for first-time investors.

Conclusion

Finding great deals on multi use commercial property isn’t about luck – it’s about being systematic and resourceful. The most successful investors I’ve met don’t rely on just one approach. They’re constantly monitoring online marketplaces while building relationships with brokers and scouring government records for early leads.

What makes this property type so exciting right now is how perfectly it aligns with changing lifestyle preferences. As Judy Guarino of JPMorgan Chase puts it, “Convenience is king in commercial real estate.” People increasingly want to live, work, shop, and play without lengthy commutes – and mixed-use properties deliver exactly that.

I’ve seen investors succeed with various strategies – some focus on transit-oriented developments where walkability commands premium rents, others hunt for diamonds in the rough in emerging neighborhoods, while some specialize in turning around distressed assets. The common thread? They all move decisively when they spot opportunity, but never skip proper due diligence.

At MicroFlex™ LLC, we’ve built our business around understanding these evolving needs. Our properties across Alabama offer the perfect middle ground – flexible spaces that combine warehouse, office, storage, and showroom features all under one roof. This multi-function approach gives businesses the mixed-use advantages without the commitment or complexity of ownership.

For growing companies not quite ready to purchase their own multi use commercial property, our spaces provide an ideal stepping stone. You get the operational benefits of combined uses with the freedom of our flexible lease terms. Many of our tenants appreciate the ability to adapt their space as their business evolves – something traditional single-use properties simply can’t offer.

Whether you’re exploring our Birmingham-Irondale location, our facilities in Huntsville, or any of our other Alabama properties, you’ll find thoughtfully designed spaces that support diverse business activities. We invite you to visit our Alabama locations to see how our innovative approach to commercial space can fuel your growth.

In multi use commercial property, patience and persistence pay off. The best deals often come to those who’ve done their homework, built solid relationships, and positioned themselves to act quickly when opportunity knocks. Happy hunting – and if you’re not quite ready to buy, we’re here to provide the flexible space you need today!