Navigating the World of Flexible Commercial Agreements

A short-term business lease is exactly what it sounds like – a commercial rental agreement that doesn’t tie you down for years. These agreements typically run less than one year, giving your business room to breathe and adapt in today’s ever-changing market.

When you’re exploring these flexible arrangements, you’ll notice some distinct characteristics. Most short-term business leases run anywhere from one month to a year, making them perfect for businesses in transition or testing new waters. Yes, you’ll generally pay a higher monthly rate compared to locking in a long-term deal – that’s the premium for flexibility. But that extra cost buys you something valuable: the freedom to pivot quickly when circumstances change.

Who benefits most from these arrangements? If you’re running a pop-up shop, managing seasonal operations, testing a new market, or need temporary office space while your permanent location is under renovation, a short-term business lease might be your perfect solution. Just be prepared for potentially higher security deposits, though you’ll typically enjoy a more streamlined application process.

In today’s business environment, agility is everything. These shorter agreements allow entrepreneurs and established companies alike to test concepts, adapt to seasonal demands, or bridge transitional periods without getting locked into multi-year commitments that might not make sense six months down the road.

The beauty of these arrangements is they create a win-win scenario. As a tenant, you gain tremendous flexibility. As a landlord, the premium rates compensate for the shorter commitment period. For businesses facing uncertainty or undergoing strategic changes, a short-term business lease offers a practical way to maintain operations while keeping your options wide open.

Having helped numerous clients steer commercial real estate decisions, I’ve seen how these flexible arrangements can be game-changers. They allow businesses to ride market waves while maintaining operational continuity and strategic positioning. For more information on commercial lease types and their legal implications, you can visit the Small Business Administration’s guide to commercial leases.

At MicroFlex™ LLC, we understand that your business needs might change from month to month, which is why our adaptable spaces and flexible terms are designed with your evolving requirements in mind.

Understanding Short-Term Business Leases

In today’s business world, having room to pivot can be worth its weight in gold. That’s exactly what short-term business leases offer – the freedom to adapt without being anchored by years-long commitments.

Definition and Duration

A short-term business lease is simply an agreement between you (the business owner) and a property owner that typically runs for less than a year. While traditional commercial leases often lock you in for 3-5 years, these shorter arrangements can be as brief as month-to-month or extend to six months or a year.

Here at MicroFlex™ LLC, we think of our short-term business leases as breathing room for your business. They give you access to our versatile spaces across Birmingham, Huntsville, and other Alabama locations without weighing you down with lengthy obligations. After all, your business needs might look very different six months from now!

Benefits for Tenants

Choosing a short-term business lease comes with plenty of perks for you as a business owner. You can dip your toes in a new location before diving in headfirst – perfect for testing whether a neighborhood brings in the right customers. When your business hits a growth spurt (or needs to downsize), you won’t be stuck in a space that no longer fits.

These flexible arrangements also shield you during uncertain times. One of our Birmingham clients put it perfectly: “The six-month lease gave us the perfect runway to test our concept. When it succeeded beyond expectations, we were able to quickly expand into a larger unit without breaking our original agreement.”

For seasonal businesses, short-term business leases are particularly valuable. Why pay for a storefront year-round when your holiday pop-up only needs space for three months? Plus, the lower upfront investment means you can preserve cash flow for other critical business needs.

Benefits for Landlords

Property owners like us also find real value in offering short-term business leases. Yes, we can charge premium rates for this flexibility – that’s just good business. But there are deeper advantages too.

These arrangements help us fill spaces that might otherwise sit empty, generating income rather than collecting dust. They also give us a chance to “date before we marry” – we can see if a tenant is reliable before offering them a longer-term home. And in rapidly changing markets, the ability to adjust rental rates more frequently helps us stay competitive.

The beauty of short-term business leases is that they create a win-win scenario. You get the flexibility to grow and adapt your business on your terms, while we maintain dynamic, thriving commercial spaces filled with innovative businesses. It’s a partnership where both sides benefit from staying light on their feet.

Comparing Short-Term and Long-Term Leases

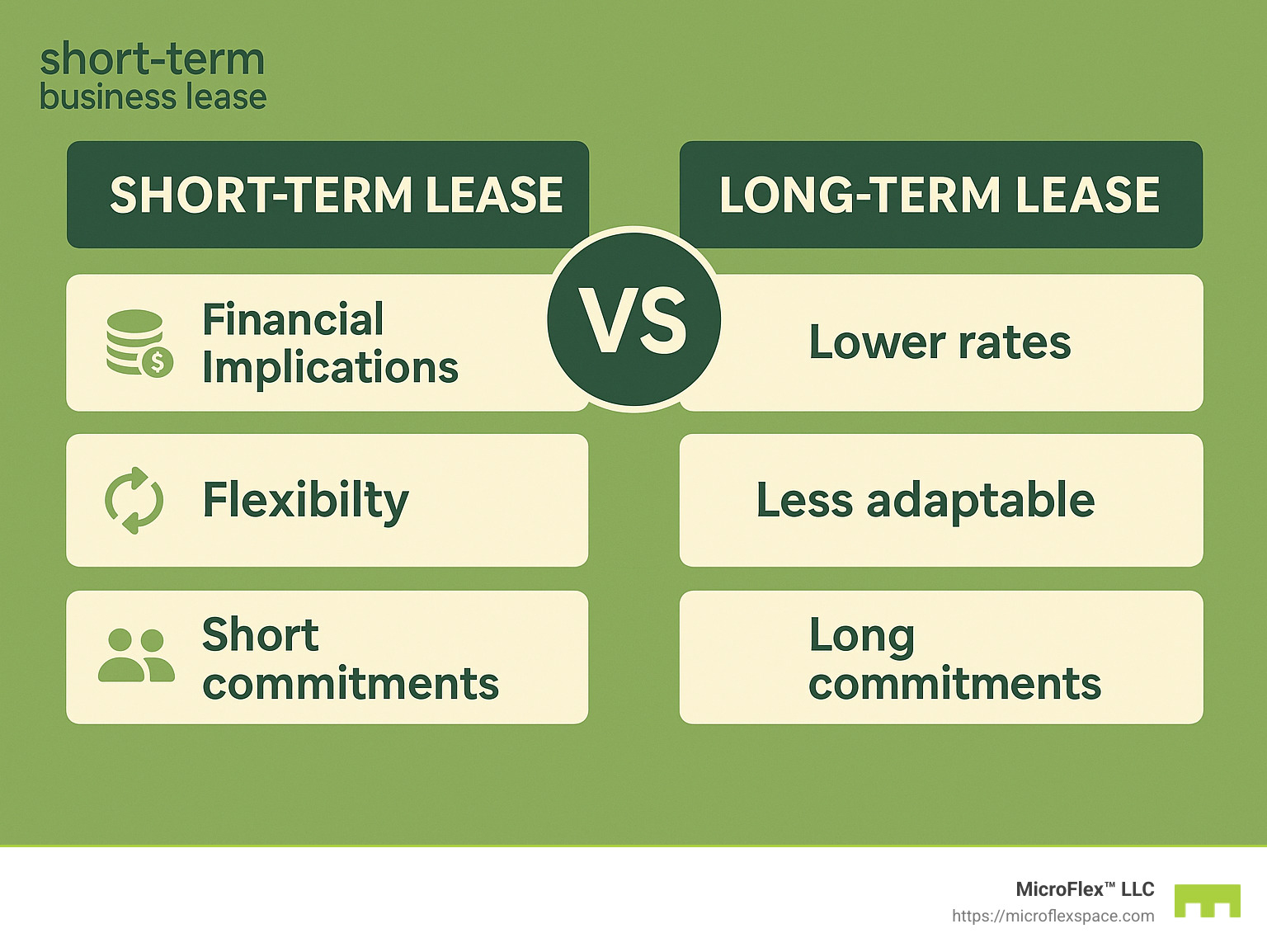

When it comes to commercial space decisions, understanding the fundamental differences between lease types can make or break your business strategy. Whether you’re just starting out or considering a change for your established company, knowing what you’re signing up for is essential.

Pros and Cons for Tenants

The beauty of a short-term business lease lies in its flexibility. Like a good dance partner, these agreements move with you as your business evolves. You can quickly pivot when market conditions change, without the weight of a lengthy commitment hanging over your head.

Many of our Birmingham tenants appreciate the opportunity to test locations before making bigger commitments. One tech startup founder told me, “The three-month lease at MicroFlex gave us breathing room to see if our client base would follow us to the new neighborhood. They did, and we renewed for another six months!”

Of course, this flexibility comes at a price. You’ll typically pay more per month than you would with a long-term agreement. It’s the premium you pay for freedom. And while you can move quickly when needed, that same flexibility means less stability – you might need to relocate more frequently than you’d like.

Another consideration is customization. With a short-term business lease, you’ll have fewer opportunities to truly make the space your own with extensive modifications. Most landlords (ourselves included) limit major renovations on shorter agreements.

Pros and Cons for Landlords

From the property owner’s perspective, short-term business leases offer some distinct advantages. The premium pricing means higher monthly revenue compared to traditional leases. At MicroFlex™ LLC, we’re transparent about this arrangement – our tenants pay a bit more for flexibility, and we earn a bit more for taking on additional turnover risk.

These shorter agreements also allow landlords to adjust rates more frequently to match market conditions. When property values in Huntsville jumped last year, we were able to make reasonable adjustments for new tenants while keeping existing relationships intact.

The downside? More tenant turnover means more work. Each transition requires cleaning, potential repairs, marketing the space, vetting new tenants, and processing paperwork. It’s a constant cycle that requires dedicated staff and efficient systems.

Income predictability can also be challenging. While long-term leases provide a stable revenue forecast for years ahead, short-term business leases create a less certain financial picture. We’ve addressed this at MicroFlex™ by maintaining a diverse portfolio of lease lengths and building strong tenant relationships that lead to renewals.

Many of our property owners have found that the increased administrative burden is offset by higher overall returns and the opportunity to host a diverse range of innovative businesses. As one of our landlord partners put it, “I’d rather have a vibrant, changing mix of tenants paying premium rates than the same tenant for ten years who might fall behind during tough times.”

The complexity of commercial lease agreements varies significantly between short and long-term options. Long-term leases often come with intricate clauses about everything from maintenance responsibilities to renewal options, while short-term business leases typically feature more straightforward terms that both parties can easily understand and implement quickly.

At MicroFlex™ LLC, we’ve worked hard to find the sweet spot that benefits both sides of the equation, creating lease structures that provide the flexibility modern businesses need while ensuring property owners receive fair compensation for the additional flexibility they provide.

Popular Uses for Short-Term Business Leases

The beauty of short-term business leases lies in their incredible versatility. These flexible arrangements have become the secret weapon for businesses across numerous industries looking to stay nimble in today’s fast-changing marketplace.

Retail and Event Spaces

The retail world has been completely transformed by the availability of short-term business leases, creating exciting new possibilities for entrepreneurs and established brands alike.

Pop-up shops have become one of the most vibrant applications, allowing retailers to create buzz and urgency without long-term commitments. During the holiday season, our MicroFlex™ space in Hoover saw this when a local entrepreneur turned a vacant unit into a festive pop-up that generated more revenue in two months than many traditional stores see in half a year!

Seasonal businesses thrive with these arrangements too. From summer vendors selling beach gear in Gulf Shores to Halloween specialty stores in Huntsville, the ability to operate only during peak demand periods dramatically improves profitability.

Brand activations represent another creative use of these spaces. When a major athletic company wanted to launch their new product line in Birmingham, they used our short-term business lease option to create an immersive brand experience for just three weeks – long enough to make an impact without the burden of a permanent location.

Art galleries and farmers markets have also acceptd this model, using temporary commercial spaces to showcase rotating exhibitions or create regular but non-permanent retail setups that keep customers coming back to find what’s new. The National Retail Federation has documented how pop-up retail continues to grow as a significant trend in the industry.

Office and Workspace Solutions

The traditional office model continues to evolve, and short-term business leases are at the forefront of this workplace revolution.

Project-based teams have finded the advantage of temporary office spaces that align perfectly with their timeline. A marketing agency in Montgomery recently used our space for a three-month campaign, creating a dedicated war room that fostered collaboration without adding permanent overhead to their business.

Remote team gatherings have become another popular use case. As one client told us, “Having a physical space where our distributed team can meet quarterly has been game-changing for our company culture – and not having to maintain it year-round is even better!”

Startups particularly love the flexibility we offer. “Our Auburn location has become a hub for tech startups looking for flexible space solutions,” notes our MicroFlex™ LLC location manager. “These companies appreciate that our short-term business leases allow them to focus on growth without the distraction of long-term real estate commitments.”

Satellite offices represent another strategic application. Businesses based in other states often use our spaces to test the Alabama market before making permanent investments. This approach minimizes risk while maximizing opportunity.

Transitional spaces round out the common uses, with businesses needing temporary locations during renovations or relocations. One Tuscaloosa accounting firm maintained seamless client service during their office remodel by using our space for just four months – exactly when they needed it.

At MicroFlex™, we’ve designed our spaces to accommodate this wide range of needs, proving that with the right short-term business lease, almost any commercial vision can become reality – even if just for a season.

Frequently Asked Questions about Short-Term Business Leases

What is the typical duration of a short-term business lease?

When businesses ask me about short-term business leases, the first question is almost always about duration. While there’s no one-size-fits-all answer, these flexible arrangements typically span from month-to-month up to one year.

Here at MicroFlex™ LLC, we’ve found our clients gravitate toward three sweet spots: 3-month terms (perfect for seasonal businesses), 6-month terms (ideal for testing new markets), and 12-month terms (offering a balance between flexibility and stability). Each option gives businesses room to breathe while they grow and evolve.

One of our Birmingham tenants recently told me, “The 3-month lease was exactly what we needed to handle our holiday rush without committing to space we wouldn’t need by February.”

How do short-term leases affect financial planning?

The financial structure of a short-term business lease creates an interesting trade-off that smart business owners learn to leverage. You’ll generally pay higher monthly rates compared to long-term commitments, but you’ll need significantly less capital upfront.

This arrangement can be a blessing for startups and growing businesses watching their cash flow. Instead of tying up thousands in deposits and prepaid rent, you can keep that money working in your business where it belongs. Many of our tenants at MicroFlex™ find this approach aligns perfectly with their growth strategy—they’re willing to pay a bit more monthly for the freedom to pivot quickly if needed.

During uncertain economic times, this reduced financial commitment can be the difference between taking a calculated risk or missing an opportunity entirely. As one tenant put it, “The premium we pay monthly is actually our insurance policy against getting stuck in the wrong location.”

Can short-term leases be renewed or extended?

Absolutely! Renewal flexibility is one of the most valuable aspects of a short-term business lease. At MicroFlex™ LLC, we’ve designed our renewal process to be refreshingly simple—much less paperwork than your initial agreement.

We’ve seen many businesses follow a predictable pattern: they start with a short 3-month lease to test the waters, renew for another 3-6 months as they gain traction, and eventually transition to a longer arrangement once they’re established. This step-by-step approach removes much of the anxiety from business expansion.

Our property managers work closely with each tenant as renewal time approaches. We’ll check in about your current needs, discuss any changes to your business, and help determine if your space still aligns with your goals. Sometimes that means renewing as-is, sometimes upgrading to a larger unit, and occasionally it means helping you transition to a different solution altogether.

As one of our long-term clients (who ironically started on our shortest lease term) likes to say, “MicroFlex™ grew with us, not against us.” That’s exactly the partnership approach we aim for with every tenant.

Conclusion

Short-term business leases represent a significant shift in how companies approach their space needs. As businesses increasingly value flexibility and agility over long-term certainty, these arrangements provide a perfect middle ground between temporary solutions and permanent commitments.

At MicroFlex™ LLC, we’ve built our business model around understanding and meeting these evolving needs. Our adaptable multi-function spaces across Birmingham, Huntsville, Auburn-Opelika, and Hoover combine warehouse, office, storage, and showroom features with the flexible lease terms modern businesses demand.

Whether you’re a startup testing a new market, an established business managing seasonal fluctuations, or an entrepreneur with a temporary project, our short-term business lease options provide the perfect balance of professional space and contractual flexibility.

The commercial real estate landscape continues to evolve, and with it, the importance of adaptable lease structures grows. By embracing short-term business leases, companies can remain nimble while still accessing the professional spaces they need to thrive.