The Rise of Multi-Use Commercial Real Estate

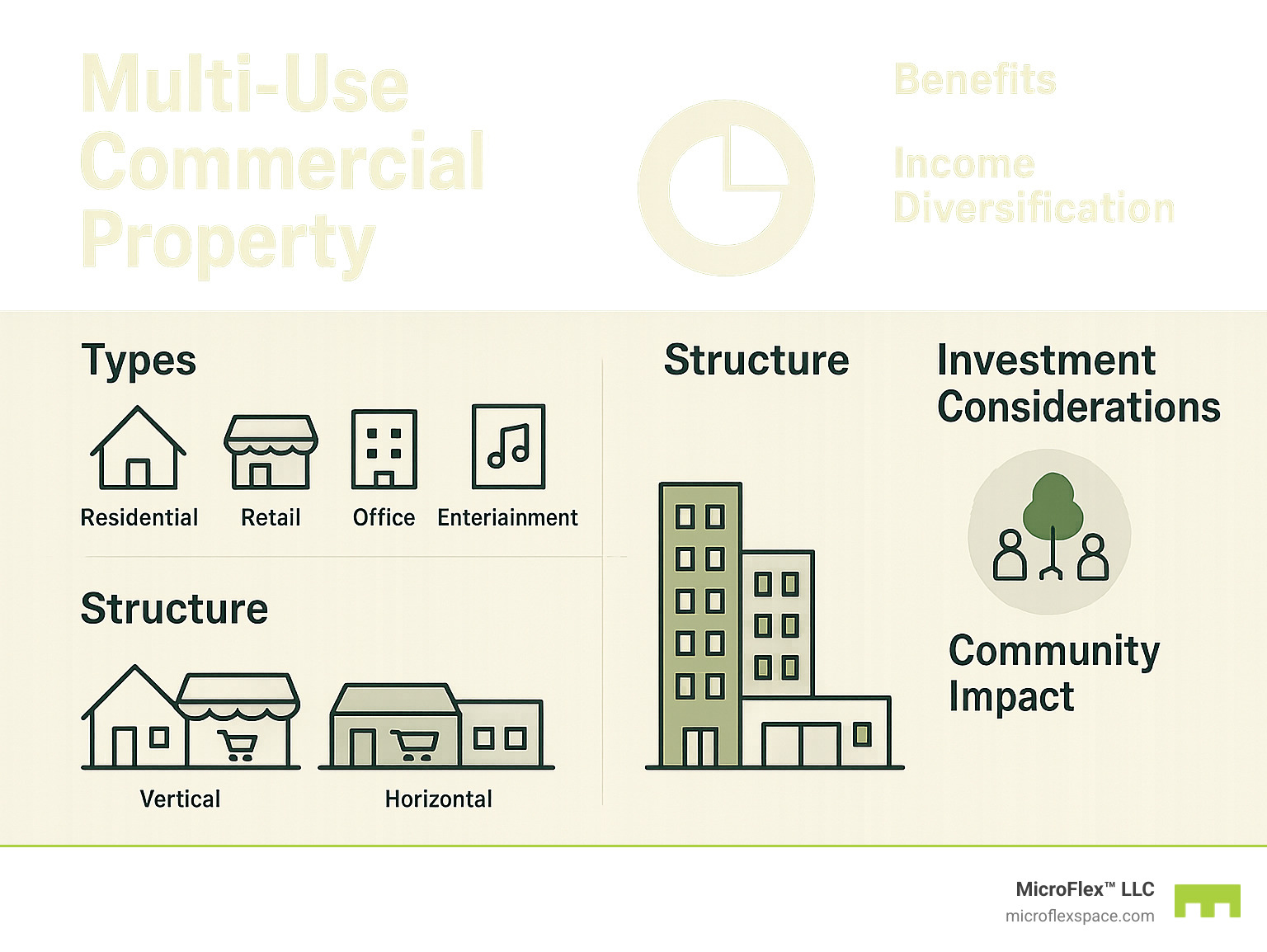

Multi-use commercial property combines multiple functions—such as residential, retail, office, and entertainment—within a single development or building. These versatile spaces are revolutionizing commercial real estate.

What is a multi-use commercial property?

* A development integrating at least two different uses (residential, commercial, cultural, or industrial)

* Can be structured vertically (different uses on different floors) or horizontally (different uses in adjacent buildings)

* Typically designed to create walkable, vibrant communities

* Often features ground-floor retail with offices or residences above

Multi-use properties have surged in popularity as consumers increasingly favor walkable, amenity-rich environments where they can live, work, shop, and play without extensive travel. This shift represents a return to traditional urban planning principles, championed by influential urbanist Jane Jacobs, who argued that mixed-use development creates more vibrant, safe, and economically resilient communities.

“Diversification has an important place in any long-term real estate portfolio, and mixed-use commercial property offers an effective way to spread risk and tap multiple income streams,” notes many industry experts. This diversification isn’t just good for investors—it’s changing neighborhoods and creating sustainable communities.

Statistics show the growing momentum behind these properties:

– Mixed-use developments can increase surrounding property values by 5-20%

– They typically maintain higher occupancy rates (often 90%+)

– The U.S. has nearly 270,000 active mixed-use property listings

Multi-use commercial property definitions:

– Business rental solutions

– Office space with storage

– Short term commercial rentals

1. What Is Multi-Use Commercial Property & How It’s Structured

Multi-use commercial property combines different functional spaces within one development, creating environments where people can live, work, shop, and play.

This approach isn’t new. Historically, cities evolved with merchants living above their shops. During the industrial era, zoning laws separated these functions to address pollution concerns. Today, we’re witnessing a return to integration, with modern amenities and sustainable design principles.

Jane Jacobs, the urban activist who changed how we think about cities, championed this approach in her 1961 book “The Death and Life of Great American Cities.” She believed diverse, integrated neighborhoods created safer, more vibrant communities—a vision now backed by decades of urban research.

Defining Multi-use commercial property

When we talk about multi-use commercial property, we’re looking at several scales of integration:

A building-level blend might feature a coffee shop and boutiques on the ground floor with apartments or offices above—all under one roof. At the neighborhood scale, you’ll find planned developments where different buildings serve complementary purposes within walking distance. What makes these truly special is their functional integration—spaces designed not just to exist side-by-side but to create meaningful interactions.

The magic happens in that intentional integration. It’s not enough to have an apartment building next to a strip mall and call it “mixed-use.” True multi-use commercial property creates environments where the whole becomes greater than the sum of its parts.

Vertical vs Horizontal Snapshot

When developing multi-use commercial properties, there are two main structural approaches:

| Feature | Vertical Mixed-Use | Horizontal Mixed-Use |

|---|---|---|

| Basic Structure | Different uses stacked on different floors | Different uses in adjacent buildings |

| Land Efficiency | Higher (smaller footprint) | Lower (requires more land) |

| Construction Complexity | More complex (different systems per floor) | Less complex (standardized by building) |

| Development Costs | Generally higher per square foot | Generally lower per square foot |

| Tenant Synergies | Strong internal connection between uses | Requires thoughtful site planning |

| Best For | Urban centers with high land costs | Suburban areas with more available land |

At MicroFlex™ LLC, we’ve implemented both approaches across our Birmingham, Huntsville, and Auburn-Opelika locations, combining warehouse, office, storage, and showroom features in configurations that maximize functionality while maintaining visual appeal.

2. Benefits Fueling the Surge in Multi-Use Developments

The remarkable growth in multi-use commercial property development isn’t happening by accident. These versatile spaces offer compelling advantages for investors, communities, and the environment.

Why Investors Love Multi-use commercial property

When you invest in a property with multiple uses, you’re essentially creating your own insurance policy. If retail tenants struggle during an e-commerce boom, your residential units keep the cash flowing. This natural diversification is like having multiple investments wrapped into one property.

These properties maintain impressive occupancy rates of 90% or higher at sale time, earning them ‘core asset’ status that serious investors love. This high occupancy occurs because these properties create ecosystems where tenants support each other.

Your investment doesn’t stop at the property line either. Studies show that mixed-use developments boost surrounding property values by 5-20%. This “halo effect” happens because walkable, amenity-rich areas command higher prices.

In times of inflation, multi-use commercial property shines. With diverse tenant types on varying lease terms, you can adjust to rising costs more nimbly than single-use properties locked into long-term leases.

At MicroFlex™ LLC, we see this flexibility benefit our tenants daily. Businesses love being able to start with a small office, add warehouse space as they grow, and eventually incorporate a showroom – all without relocating.

Urban & Social Payoffs

The benefits extend far beyond the balance sheet – they’re changing how we live, work, and connect.

When daily needs sit within walking distance, something magical happens. Cars stay parked, streets come alive with pedestrians, and chance encounters create community. A study in Guangzhou, China confirmed that mixed-use zones significantly reduce taxi travel distances by making walking the easier choice.

Multi-use commercial properties foster genuine community connections. When residents become regulars at local businesses, they’re not just customers – they’re neighbors. During COVID-19, purely commercial districts became ghost towns, while mixed-use areas maintained vitality through their residential components.

The safety benefits can’t be overlooked either. Jane Jacobs’ “eyes on the street” principle proves true – mixed-use areas with activity throughout day and evening tend to be safer due to natural surveillance.

Research published in the Urban Climate journal demonstrates that mixed-use developments significantly reduce carbon emissions through both reduced transportation needs and more efficient building systems.

At our Birmingham, Huntsville, and Auburn-Opelika locations, we’ve watched as our business rental solutions create mini-ecosystems where neighboring businesses support each other through proximity and shared customer bases.

3. Challenges, Risks & Mitigation Strategies

While multi-use commercial properties offer incredible benefits, they come with unique challenges. Let’s explore the real issues and effective solutions.

Complex Management Requirements

Managing a property where diverse businesses and residential tenants share space isn’t straightforward. Each tenant type brings different expectations, maintenance needs, and communication styles.

A residential tenant might call at midnight about a leaky faucet, while your retail tenant needs foot traffic analysis and your office tenant worries about internet reliability. This diversity demands management teams with broader expertise than single-use properties require.

At MicroFlex™ LLC, we’ve developed specialized protocols for our managed office spaces that accommodate the unique needs of different businesses sharing our developments.

Zoning and Regulatory Problems

Despite growing enthusiasm for mixed-use development, many cities still operate with outdated zoning codes. You might spend months navigating zoning variances, parking requirement negotiations, building codes not written for mixed-use, and lengthy approval timelines.

Higher Capital Expenditures

Multi-use commercial properties simply cost more to build and maintain. They require sophisticated building systems that can handle different usage patterns, multiple entrances and security protocols, diverse utility configurations, sound isolation between different uses, and more complex maintenance schedules.

Financing Challenges

Many financial institutions specialize in specific property types and get nervous with mixed-use projects. This often results in multiple financing sources with different terms, slightly higher interest rates, extensive documentation requirements, and longer underwriting processes.

Social Equity Concerns

While these properties can revitalize neighborhoods, they can also displace existing communities if not carefully planned. High-profile examples like Hudson Yards received billions in public subsidies yet created primarily luxury spaces that many felt didn’t serve the broader community.

Key Risk-Mitigation Moves

Experienced investors have developed effective strategies to address these challenges:

Balanced Tenant Mix makes all the difference. Carefully curate complementary tenants that create synergy rather than conflict. That noisy restaurant might clash with luxury condos but could perfectly complement creative office space.

Phased Development allows you to learn as you go, adjusting based on market response and lessons learned from earlier phases.

Experienced Management is non-negotiable. Either hire property management teams with specific mixed-use experience or create separate management structures for different property components.

Comprehensive Insurance Planning ensures you’re covered for the unique risks of each use type while preventing coverage gaps between them.

Adequate Contingency Reserves provide peace of mind. Maintain larger capital reserves than you would for single-use properties to address the inevitably more complex maintenance needs.

4. Financing, Zoning & Due-Diligence Playbook

Successful multi-use commercial property investment requires mastering financing options, zoning considerations, and thorough due diligence.

Financing Options for Mixed-Use Properties

Traditional banks offer commercial real estate loans typically requiring 20-25% down with 5-10 year terms. These work well for established investors with strong credit profiles.

For business owners planning to occupy at least half their property, the SBA 504 program offers down payments as low as 10% with competitive interest rates. This makes ownership more accessible while generating rental income from other portions of the building.

Properties with substantial residential components might qualify for FHA 223(f) or 221(d)(4) financing through HUD, featuring lower down payments and longer terms.

Larger developments often use private equity partnerships or joint ventures, while public financing tools like Tax Increment Financing (TIF) can support community revitalization projects.

Navigating Zoning for Mixed-Use Success

Many cities now have specific mixed-use zoning designations, including vertical mixed-use zones, horizontal mixed-use districts, neighborhood mixed-use categories, and transit-oriented development zones.

Parking requirements often present the biggest hurdle, but progressive cities offer solutions like shared parking allowances (recognizing that residential and office uses peak at different times) and reduced ratios near transit hubs.

Density bonuses provide opportunities to build more floor area or height than normally allowed, typically in exchange for community benefits like affordable housing, public space, green building features, or transit improvements.

Form-based codes focus on how buildings relate physically rather than strictly separating uses, often making mixed-use development easier by emphasizing good design over rigid use separation.

Must-Have Checklist Before You Buy

Before investing in a multi-use commercial property, complete a comprehensive due diligence process:

- Location analysis: Evaluate walkability score, transit access, demographic trends, nearby employment centers, and competitive properties

- Market demand studies: Examine absorption rates for each use type, rent trends, vacancy patterns, and tenant retention history

- Financial analysis: Create detailed pro forma statements by use type, sensitivity analysis for different scenarios, cap rate comparisons, operating expense ratios, and replacement reserves

- Physical assessment: Review building systems compatibility, ADA compliance, environmental site assessment findings, structural engineering, and utility capacity

- Exit strategy: Assess the likely buyer pool, analyze comparable sales, identify value-add opportunities, and consider condominium conversion potential

According to JPMorgan’s commercial real estate insights, these properties continue gaining popularity because they create vibrant neighborhoods, support sustainability goals, and align with changing consumer preferences for walkable, amenity-rich environments.

At MicroFlex™ LLC, we’ve implemented this integrated approach with our multi-use commercial property offerings, creating spaces where businesses can grow and adapt within a single location.

5. Finding & Operating Your Multi-Use Asset

Finding and successfully managing a multi-use commercial property requires strategy, insight, and a knack for seeing potential where others might miss it.

Finding Multi-Use Opportunities

While the U.S. has nearly 270,000 active mixed-use listings, finding the right one takes strategy. Commercial databases provide a starting point, but at MicroFlex™ LLC, we’ve found some of our best Birmingham and Huntsville properties through relationships with local brokers who understand our vision.

Don’t overlook adaptive reuse—tired office buildings, aging shopping centers, or historic industrial spaces often hold tremendous potential. There’s something deeply satisfying about breathing new life into a forgotten property while preserving its character.

Many cities actively encourage mixed-use development through RFPs for publicly-owned parcels, sometimes with financial incentives that improve project viability.

In developing our portfolio across Alabama, we’ve learned to look beyond the obvious, seeking locations where different uses genuinely complement each other.

Operating Multi-Use Properties Successfully

Tenant mix becomes your secret sauce. Rather than filling spaces with whoever can pay the rent, create an ecosystem where businesses support each other. A coffee shop serving morning commuters from upstairs apartments might also become the lunch spot for nearby office workers.

Management structures need careful consideration. Some properties work best with specialized teams for different components, while others thrive under unified management with cross-trained staff.

Common area maintenance requires thoughtful allocation—the restaurant with heavy foot traffic has different impacts than the quiet professional office. Fair distribution of these costs helps maintain tenant satisfaction.

Technology has become essential in our management approach, from access control systems accommodating different operating hours to maintenance request platforms that prioritize by use type.

Case Highlights & Global Examples

Hudson Yards in New York City stands as perhaps the most ambitious example—a 28-acre development creating essentially a new neighborhood from scratch. With 16 skyscrapers mixing offices, residences, hotels, retail, and cultural venues, it demonstrates how complex financing can make seemingly impossible projects viable.

Portland, Oregon offers lessons in thoughtful zoning with its tiered approach to mixed-use development, recognizing that different scales are appropriate for different contexts.

European cities remind us that mixed-use can be the default rather than the exception. The typical European urban pattern—shops below, living above—creates naturally vibrant streets without requiring special planning designations.

In Birmingham, we’ve seen wonderful local successes like The Pizitz, where a former department store now houses a food hall, retail spaces, and apartments. Similarly, Pepper Place transformed from a Dr. Pepper plant into a vibrant mix of restaurants, design firms, and a popular farmers market.

At MicroFlex™ LLC, we’ve incorporated these lessons while adapting to Alabama markets. Our spaces combine flexibility with functionality, creating environments where businesses can grow and evolve over time.

Frequently Asked Questions about Multi-Use Commercial Property

What use combinations generate the best returns?

The classic ground-floor retail with residential above remains a winning formula. This arrangement works beautifully when retail spaces serve everyday needs—think coffee shops, grocery stores, or pharmacies. Residents enjoy the convenience, retail tenants benefit from built-in customers, and property owners enjoy the blend of higher retail rents with residential stability.

Office spaces paired with supporting retail and services create another powerful combination. When office workers can grab lunch, squeeze in a workout, or pick up dry cleaning without leaving the development, the office space itself becomes more valuable.

For creative professionals and entrepreneurs, live-work configurations offer a compelling lifestyle choice. These spaces eliminate commutes and create flexible boundaries between personal and professional life. The efficiency of combining living and working spaces often allows owners to command premium pricing while tenants still feel they’re getting excellent value.

At MicroFlex™ LLC, our experience has taught us that flexibility is key. Businesses evolve, and spaces that can adapt alongside them maintain the strongest tenant relationships and financial performance over time.

How do zoning laws shape mixed-use feasibility?

Many older communities still operate under traditional Euclidean zoning codes that separate uses into distinct zones, requiring special permits or variances for mixed-use projects.

The good news is that zoning is evolving. Form-based codes focus more on how buildings look and relate to their surroundings rather than strictly separating uses, often welcoming mixed-use development by default.

For larger projects, Planned Unit Development (PUD) designations offer a negotiated approach. Developers and municipalities can work together to create custom zoning that allows mixed-use in exchange for community benefits.

Many cities have created special mixed-use overlay districts in strategic areas like downtown cores or along transit corridors, modifying underlying zoning to encourage integrated uses.

The trend is clearly moving toward zoning that facilitates rather than hinders mixed-use development, though progress varies dramatically by region.

Where can I quickly locate mixed-use listings?

Specialized commercial real estate databases like CommercialEdge, CoStar, and Crexi offer powerful search tools specifically designed for mixed-use properties.

Don’t underestimate the value of local broker relationships. Commercial real estate professionals with mixed-use expertise often know about opportunities before they hit the public market.

Many municipal economic development offices maintain inventories of available properties suitable for mixed-use development, particularly in areas targeted for revitalization.

For those willing to be proactive, direct mail campaigns targeting owners of properties with mixed-use potential can uncover opportunities before competition emerges.

At MicroFlex™ LLC, we’ve built strong relationships with brokers and property owners throughout Alabama to identify promising opportunities before they reach the wider market.

Conclusion

Multi-use commercial property represents a fundamental shift in how we’re building communities that last. These versatile developments blend different functions to create spaces that are more resilient, sustainable, and engaging than single-use properties.

For investors, the advantages are compelling. You get built-in diversification across different market sectors, helping weather economic storms. These properties consistently show higher occupancy rates and better tenant retention—businesses and residents want to be part of vibrant, mixed communities. Property values tend to appreciate more steadily, and you’re perfectly positioned for today’s consumer who seeks walkable neighborhoods.

Communities win too. When people can walk to work, shopping, and entertainment, we see measurable reductions in traffic and carbon emissions. Infrastructure costs drop when we build up rather than out. The natural rhythm of different uses creates neighborhoods that are alive throughout the day and evening, with constant activity creating safer streets through natural surveillance.

At MicroFlex™ LLC, we’ve seen that the magic happens when different uses don’t just coexist but actively improve each other. In our Birmingham, Huntsville, and Auburn-Opelika locations, we’ve carefully designed spaces where warehouse functionality, professional offices, convenient storage, and attractive showrooms come together seamlessly. A business might start with just an office but expand into adjacent warehouse space as they grow—all without the disruption of relocating.

The future belongs to commercial real estate that can flex and adapt. Today’s business might need one configuration, but tomorrow’s needs could be entirely different. Properties that accept this flexibility while contributing positively to their surroundings will outperform those stuck in rigid, single-use thinking.

If you’re curious about how our adaptable spaces might work for your business needs, visit our locations page to find the MicroFlex™ facility nearest you, and let’s talk about creating a space that works as hard as you do.